Home > Schools & Programs > AI Innovation Series > Schedule

AI Innovation Series

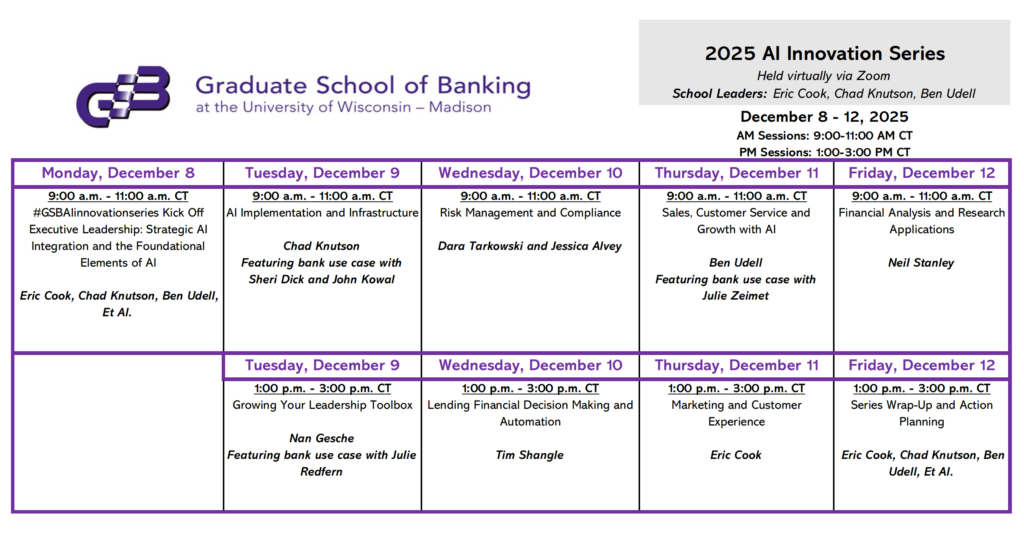

Section: December 8-12, 2025

This program is offered virtually over a series of half day sessions.

Enrollment Deadline: December 1, 2025.

Schedule

The 2025 program will be held over 9 sessions between December 8-12.

All live classes will be recorded and available for 6 months.

High-level orientation for all attendees, including C-Suite leaders, on aligning AI with banking strategy, governance, and ROI.

- High-level AI Education and Overview

- How AI fits into your Banking Strategy

- AI Governance and Ethical Leadership

- Learn from real-world case studies of banks using AI at scale

- Intro to AI Prompting

Exploring models, tools, data privacy, and cybersecurity considerations for operationalizing AI.

- Understand AI models and tools

- AI System Security and Operational Risk – how to address data privacy, integration, and security

- AI Enterprise – What could a future state look like?

- Understand generally available tools vs. specialized vendors

Focus on compliance automation and vendor solutions for risk professionals.

- Vendor Management in the Age of AI

- Selecting vendors to solve problems

- Asking the right questions to understand and manage the risk

- AI in Regulatory Compliance and Reporting

- Navigating the regulatory requirements

- Privacy and Legal Compliance

How AI can shape your marketing strategy and campaign creation through customer personalization, generative content, and lifecycle engagement.

- Best Practices and Training

- Use AI for content creation across media

- Deliver hyper-personalized customer experiences

- Connect marketing strategy with business outcomes

- Analyzing campaign and marketing data

AI in credit analysis, loan origination, and portfolio monitoring for lending professionals.

- Use AI to improve credit analysis – how AI can help lenders understand their prospective and current customers

- Automate the basic loan origination workflows

- Apply AI for portfolio monitoring and risk forecasting

- Opportunities to streamline processes with RPA tools

- Customer communication

Leverage AI to develop sales strategy to maximize growth and customer success.

- Leverage external data for sales planning

- Strengthen customer service training with AI

- Improved Customer Communication – Anticipate customer communication barriers

Helping leaders prepare their workforce for the future of AI-driven roles and change management.

- Ethics, Change Management and Human-Centered AI

- Workforce Planning and Skills Transformation – Plan for reskilling and job augmentation

- Integrating AI into your talent management strategy

- Workforce training

Practical use of AI for financial analysis, decision modeling, and scenario planning.

- Enhance financial analysis with AI tools

- Develop effective prompts for financial insights

- Model outcomes based on organizational goals

- Hands-on application with sample datasets and scenarios

Synthesizing lessons from the week and building an actionable roadmap for AI adoption in your bank.

- Reflect on key takeaways from each session

- Create an action plan for AI adoption

- Share best practices across institutions

- Define next steps and accountability measures